Choose the accountant whose focus

is helping small businesses and individuals with a wide range of accounting

services that answer important financial questions.

Trust

Professionalism

Confidence

Integrity

|

| |

Dear

Clients and Friends:

As 2014 draws to a close, there is still time to reduce your

2014 tax bill and plan ahead for 2015. This letter highlights

several potential tax-saving opportunities for you to consider.

If you have any questions about your particular situation please

give me a call.

As a general reminder there are several ways in which you

can file an income tax return: married filing jointly, head of

household, single, and married filing separately. A married

couple, which now includes legally recognized same-sex

marriages, may elect to file one return reporting their combined

income computing the tax liability using the tax tables or rate

schedules for “Married Persons Filing Jointly.” If a married

couple files separate returns, under certain situations they can

amend and file jointly, but they cannot amend a jointly filed

return and file separately. A joint return may be filed even

though one spouse has neither gross income nor deductions. If

one spouse dies during the year, the surviving spouse may file a

joint return for the year in which his or her spouse died.

Certain married persons who do not elect to file a joint return

may be entitled to use the lower head of household tax rates.

Generally, in order to qualify as a head of household, you must

not be a resident alien, you must satisfy certain marital status

requirements, and you must maintain a household for a qualifying

child or any other person who is you dependent, if you are

entitled to a dependency deduction for the taxable year for such

person.

Basic Numbers You Need to Know

Because many

tax benefits are tied to or limited by adjusted gross income (AGI)

– IRA deductions, education credits, child tax credit,

dependent care expense credit, etc. – a key aspect of tax

planning is to estimate both your 2014 and 2015 AGI. Also, when

considering whether to accelerate or defer income or deductions,

you should be aware of the impact this action may have on your

AGI and your ability to maximize itemized deductions that are

tied to AGI. Your 2013 tax return and your 2014 pay stubs and

other income and deduction related materials are a good starting

point for estimating your AGI.

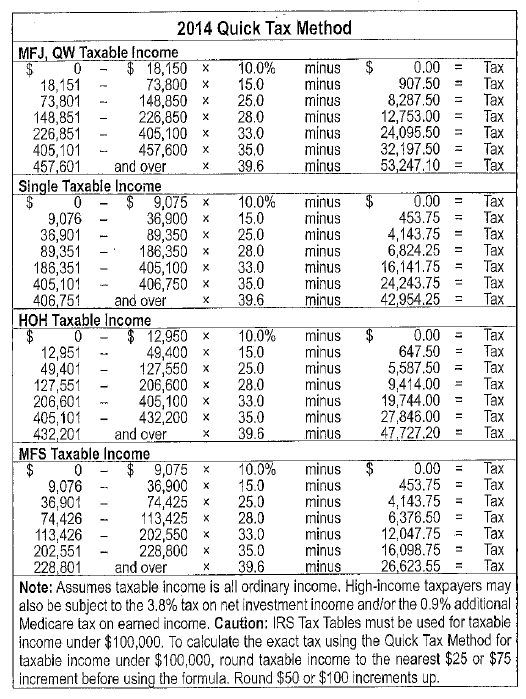

Another

important number is your “tax bracket,” i.e., the rate at

which your last dollar of income is taxed. The tax rates for

2014 have not changed from 2013 and are 10%, 15%, 25%, 28%, 33%,

35% and finally, 39.6%. Although tax brackets are indexed for

inflation, if your income increases faster than the inflation

adjustment, you may be pushed into a higher bracket. If so, your

potential benefit from any tax-saving opportunity is increased

(as is the cost of overlooking that opportunity).

This is the

link to the 2013 tax tables - http://www.irs.gov/pub/irs-pdf/i1040tt.pdf.

The 2014 tables should be published shortly. There is a

quick method chart below for 2014.

|

|

|

|

Gift Giving.

The most

commonly used method for tax-free giving is the annual gift tax

exclusion, which, for 2014, allows a person to give up to

$14,000 to each donee without reducing the giver’s estate and

lifetime gift tax exclusion amount. A person is not limited as

to the number of donees to whom he or she may make such gifts.

The annual exclusion is applied on a per-donee basis. In

addition, because spouses may combine their exemptions in a

single gift from either spouse, married givers may double the

amount of the exclusion to $28,000 per donee. A person may not

carry over his or her annual gift tax exclusion amount to the

next calendar year. Qualifying tuition payments and medical

payments do not count against this limit.

|

|

IRA,

Retirement Savings Rules for 2014

Tax-saving opportunities continue for

retirement planning due to the availability of Roth IRAs,

changes that make regular IRAs more attractive, and other

retirement savings incentives.

Traditional

IRAs: Individuals who are not active

participants in an employer pension plan may make deductible

contributions to an IRA. The annual deductible contribution

limit for an IRA for 2014 is $5,500. For 2014, a $1,000

“catch-up” contribution is allowed for taxpayers age 50 or

older by the close of the taxable year, making the total limit

$6,500 for these individuals. Individuals who are active

participants in an employer pension plan also may make

deductible contributions to an IRA, but their contributions are

limited in amount depending on their AGI. For 2014, the AGI

phase-out range for deductibility of IRA contributions is

between $60,000 and $70,000 of modified AGI for single persons

(including heads of households), and between $96,000 and

$116,000 of modified AGI for married filing jointly. Above these

ranges, no deduction is allowed.

In addition, an individual will not be

considered an “active participant” in an employer plan

simply because the individual's spouse is an active participant

for part of a plan year. Thus, you may be able to take the full

deduction for an IRA contribution regardless of whether your

spouse is covered by a plan at work, subject to a phase-out if

your joint modified AGI is $181,000 to $191,000 ($0 - $10,000 if

married filing separately) for 2014. Above this range, no

deduction is allowed.

Spousal

IRA: If an individual files a joint return and

has less compensation than his or her spouse, the IRA

contribution is limited to the lesser of $5,500 for 2014 plus

age 50 catch-up contributions, or the total compensation of both

spouses reduced by the other spouse's IRA contributions

(traditional and Roth).

Roth

IRA: This type of IRA permits nondeductible

contributions of up to $5,500 for 2014. Earnings grow tax-free,

and distributions are tax-free provided no distributions are

made until more than five years after the first contribution and

the individual has reached age 591/2.

Distributions may be made earlier on account of the individual's

disability or death. The maximum contribution is phased out in

2014 for persons with an AGI above certain amounts: $181,000 to

$191,000 for married filing jointly, and $114,000 to $129,000

for single taxpayers (including heads of households); and

between $0 and $10,000 for married filing separately who lived

with the spouse during the year.

Roth

IRA Conversion Rule: Funds in a traditional IRA

(including SEPs and SIMPLE IRAs), §401(a) qualified retirement

plan, §403(b) tax-sheltered annuity or §457 government plan

may be rolled over into a Roth IRA. Such a rollover, however, is

treated as a taxable event, and you will pay tax on the amount

converted. No penalties will apply if all the requirements for

such a transfer are satisfied.

If you already made a conversion earlier

this year, you have the option of undoing the conversion. This

is a useful strategy if the investments have gone down in value

so that if you were to do the conversion now, your taxes would

be lower. This is a complicated calculation and we should meet

to determine what your best options are.

In addition, for 2014, if your §401(k)

plan, §403(b) plan, or governmental §457(b) plan has a

qualified designated Roth contribution program, a distribution

to an employee (or a surviving spouse) from such account under

the plan that is not a designated Roth account is permitted to

be rolled over into a designated Roth account under the plan for

the individual.

|

|

|

|

401(k)

Contribution: The §401(k) elective deferral

limit is $17,500 for 2014. If your §401(k) plan has been

amended to allow for catch-up contributions for 2014 and you

will be 50 years old by December 31, 2014, you may contribute an

additional $5,500 to your §401(k) account, for a total maximum

contribution of $23,000 ($17,500 in regular contributions plus

$5,500 in catch-up contributions).

SIMPLE

Plan Contribution: The SIMPLE plan deferral limit is

$12,000 for 2014. If your SIMPLE plan has been amended to allow

for catch-up contributions for 2014 and you will be 50 years old

by December 31, 2014, you may contribute an additional $2,500.

Catch-Up

Contributions for Other Plans: If you will be

50 years old by December 31, 2014, you may contribute an

additional $5,500 to your §403(b) plan, SEP or eligible §457

government plan.

Saver's

Credit: A nonrefundable tax credit is

available based on the qualified retirement savings

contributions to an employer plan made by an eligible

individual. For 2014, only taxpayers filing joint returns with

AGI of $60,000 or less, head of household returns with AGI of

$45,000 or less, or single returns (or separate returns filed by

married taxpayers) with AGI of $30,000 or less, are eligible for

the credit. The amount of the credit is equal to the applicable

percentage (10% to 50%, based on filing status and AGI) of

qualified retirement savings contributions up to $2,000.

Required

Minimum Distributions: For 2014, taxpayers

must take their required minimum distribution from IRAs or

defined contribution plans (§401(k) plans, §403(a) and §403(b)

annuity plans, and §457(b) plans that are maintained by a

governmental employer) after attaining age 70½. The amount of

the distribution is based on life expectancy tables. It is best

to arrange to take RMDs well before the end of the year to avoid

any potential problems. The penalty for a failure is severe: It

is equal to 50% of the required amount (less any amount you have

received). However, be aware of this special exception. If you

are still working and not a 5%-or-more owner of the business you

are employed by, you can postpone RMDs from the employer’s

qualified plan until retirement. This rule does not apply to

RMDs from IRAs.

Maximize Retirement Savings:

In many cases, employers will require you to set your 2015

retirement contribution levels before January 2015. If you did

not elect the maximum 401(k) contribution for 2014, you can

increase your amount for the remainder of 2014 to lower your AGI

in order to take advantage of some of the tax breaks described

above. In addition, maximizing your contribution is generally a

good tax-saving move. |

|

|

|

Deduction

Planning

Individual

Deductions

Deduction timing is also an important

element of year-end tax planning. Deduction planning is complex,

however, due to factors such as AGI levels, AMT, and filing

status. If you are a cash-method taxpayer, remember to keep the

following in mind:

Deduction

in Year Paid: An expense is only deductible in

the year in which it is actually paid. Under this rule, if your

tax rate is going to increase in 2015, it is a smart strategy to

postpone deductions until 2015.

Payment

by Check: Date checks before the end of the

year and mail them before January 1, 2015.

Promise to Pay: A promise to pay or

providing a note does not permit you to deduct the expense. But

you can take a deduction if you pay with money borrowed from a

third party. Hence, if you pay by credit card in 2014, you can

take the deduction even though you won't pay your credit card

bill until 2015.

AGI

Limits: For 2014, the overall limitation on

itemized deductions (“Pease” limitation) applies for

taxpayers whose AGI exceeds an “applicable amount.” For

2014, the applicable amount is $305,050 for a married couple

filing a joint return or a surviving spouse, $279,650 for a head

of household, $254,200 for an unmarried individual, and $152,525

for a married individual filing a separate return. In addition,

certain deductions may be claimed only if they exceed a

percentage of AGI: 10% for medical expenses (7.5% for certain

older taxpayers), 2% for miscellaneous itemized deductions, and

10% for casualty losses.

Standard

Deduction Planning: Deduction planning is also

affected by the standard deduction. For 2014 returns, the

standard deduction is $12,400 for married taxpayers filing

jointly, $6,200 for single taxpayers, $9,100 for heads of

households, and $6,200 for married taxpayers filing separately.

As you can see from the numbers, for 2014, the standard

deduction for married taxpayers is twice the amount as that for

single taxpayers. If your itemized deductions are relatively

constant and are close to the standard deduction amount, you

will obtain little or no benefit from itemizing your deductions

each year. But simply taking the standard deduction each year

means you lose the benefit of your itemized deductions. To

maximize the benefits of both the standard deduction and

itemized deductions, consider adjusting the timing of your

deductible expenses so that they are higher in one year and

lower in the following year. You can do this by paying in 2014

deductible expenses, such as mortgage interest due in January

2015.

Medical

Expenses: For 2014, medical expenses,

including amounts paid as after tax health insurance premiums,

are deductible only to the extent that they exceed 10% of AGI

(7.5% for taxpayers age 65 or older).

State

Taxes: If you anticipate a state income tax liability for

2014 and plan to make an estimated payment most likely due in

January, consider making the payment before the end of 2014.

However, too high a payment could lead towards being subject to

the AMT.

Charitable

Contributions: Consider making your charitable

contributions at the end of the year. This will give you use of

the money during the year and simultaneously permit you to claim

a deduction for that year. You can use a credit card to charge

donations in 2014 even though you will not pay the bill until

2015. A mere pledge to make a donation is not deductible,

however, unless it is paid by the end of the year. Note,

however, for claimed donations of cars, boats and airplanes of

more than $500, the amount available as a deduction will

significantly depend on what the charity does with the donated

property, not just the fair market value of the donated

property. If the organization sells the property without any

significant intervening use or material improvement to the

property, the amount of the charitable contribution deduction

cannot exceed the gross proceeds received from the sale.

To avoid capital gains, you may want to

consider giving appreciated property to charity. Furthermore, if

you donate appreciated property held for more than one year, you

can generally deduct an amount equal to the property’s current

fair market value.

Regarding charitable contributions please remember the

following rules: (1) no deduction is allowed for charitable

contributions of clothing and household items if such items are

not in good used condition or better; (2) the IRS may deny a

deduction for any item with minimal monetary value; and (3) the

restrictions in (1) and (2) do not apply to the contribution of

any single clothing or household item for which a deduction of

$500 or more is claimed if the taxpayer includes a qualified

appraisal with his or her return. Charitable contributions of

money, regardless of the amount, will be denied a deduction,

unless the donor maintains a cancelled check, bank record, or

receipt from the donee organization showing the name of the

donee organization, the date and amount of the contribution. If

you donate $250 or more in any one day to any one organization

you must have written acknowledgement from the organization and

it must state whether or not any goods or services were received

in exchange for the donation.

However, be aware that other limits may apply to

charitable deductions.

A special provision gives taxpayers the

ability to distribute tax-free to charity up to $100,000 from a

traditional or Roth IRA maintained for an individual who has

reached age 701/2. |

|

|

|

Education

and Child Tax Benefits

Child

Tax Credit: A tax credit of $1,000 per

qualifying child under the age of 17 is available on this year's

return. In order to qualify for 2014, the taxpayer must be

allowed a dependency deduction for the qualifying child. Another

qualifying determination is that the qualifying child must be

younger than you. The credit is phased out at a rate of $50 for

each $1,000 (or fraction of $1,000) of modified AGI exceeding

the following amounts: $110,000 for married filing jointly;

$55,000 for married filing separately; and $75,000 for all other

taxpayers. These amounts are not adjusted for inflation. A

portion of the credit may be refundable. For 2014, the threshold

earned income level to determine refundability is set by statute

at $3,000 for tax years 2008 through 2018.

Credit

for Adoption Expenses: For 2014, the adoption

credit limitation is $13,190 of aggregate expenditures for each

child, except that the credit for an adoption of a child with

special needs is deemed to be $13,190 regardless of the amount

of expenses. The credit ratably phases out for taxpayers whose

income is between $197,880 and $237,880.

Education

Credits: Back in 2009, significant changes

were put in place for the Hope credit, including a name change

to the American Opportunity Tax Credit. Due to legislation in

early 2013, these changes continue through 2017. The maximum

credit for 2014 is $2,500 (100% on the first $2,000, plus 25% of

the next $2,000) for qualified tuition and fees paid on behalf

of a student (i.e., the taxpayer, the taxpayer's spouse, or a

dependent) who is enrolled on at least a half-time basis. The

credit is available for the first four years of the student's

post-secondary education. For 2014, the credit is phased out at

modified AGI levels between $160,000 and $180,000 for joint

filers, and between $80,000 and $90,000 for other taxpayers.

Forty percent of the credit is refundable, which means that you

can receive up to $1,000 even if you owe no taxes. The term

“qualified tuition and related expenses” includes

expenditures for “course materials” (books, supplies, and

equipment needed for a course of study whether or not the

materials are purchased from the educational institution as a

condition of enrollment or attendance). One way to take

advantage of the credit for 2014 is to prepay the spring 2015's

tuition. In addition, if your child's books for the spring

semester are known, those can be bought and the costs qualify

for the credit.

The Lifetime Learning credit maximum in

2014 is $2,000 (20% of qualified tuition and fees up to

$10,000). A student need not be enrolled on at least a half-time

basis so long as he or she is taking post-secondary classes to

acquire or improve job skills. As with the Hope (American

Opportunity Tax Credit in 2014) credit, eligible students

include the taxpayer, the taxpayer's spouse, or a dependent. For

2014, the Lifetime Learning credit are phased out at modified

AGI levels between $108,000 and $128,000 for joint filers, and

between $54,000 and $64,000 for single taxpayers.

Coverdell

Education Savings Account: For 2014, the

aggregate annual contribution limit to a Coverdell education

savings account is $2,000 per designated beneficiary of the

account. The limit is phased out for individual contributors

with modified AGI between $95,000 and $110,000 and joint filers

with modified AGI between $190,000 and $220,000. The

contributions to the account are nondeductible but the earnings

grow tax-free.

Student

Loan Interest: You may be eligible for an

above-the-line deduction for student loan interest paid on any

“qualified education loan.” The maximum deduction is $2,500.

The deduction for 2014 is phased out at a modified AGI level

between $130,000 and $160,000 for joint filers, and between

$65,000 and $80,000 for individual taxpayers.

Kiddie

Tax: For 2014, the kiddie tax applies to: (1)

children under 18; (2) 18-year old children who have unearned

income in excess of the threshold amount, do not file a joint

return and who have earned income, if any, that does not exceed

one-half of the amount of the child's support; and (3) children

between the ages of 19 and 23 and if, in addition to the above

rules, they are full-time students. For 2014, the kiddie tax

threshold amount is $2,000. |

|

|

|

Energy

Incentives

Residential

Energy Efficient Property Credit: Until 2016,

tax incentives are available to taxpayers who install certain

energy efficient property, such as photovoltaic panels, solar

water heating property, fuel cell property, small wind energy

property and geothermal heat pumps. A credit is available for

the expenditures incurred for such property up to a specific

percentage, except that a cap applies for fuel cell property.

The property purchased cannot be used to heat swimming pools or

hot tubs. If you have made improvements to your home or plan to

by the end of 2014, please contact me to discuss the amount of

the credit you may qualify for. |

|

|

|

The

following rules apply for most capital assets in 2014:

• Capital gains on property held one year

or less are taxed at an individual's ordinary income tax rate.

• Capital gains on property held for more

than one year are taxed at a maximum rate of 20% (0% if an

individual is in the 10% or 15% marginal tax bracket; 15% for

individuals in the 25%, 28%, 33% and 35% brackets).

Continuing from enactment in 2013, a 3.8%

tax is levied on certain unearned income. The tax is levied on

the lesser of net investment income or the amount by which

modified AGI exceeds certain dollar amounts ($250,000 for joint

returns and $200,000 for individuals). Investment income is: (1)

gross income from interest, dividends, annuities, royalties, and

rents (other than from a trade or business); (2) other gross

income from any business to which the tax applies; and (3) net

gain attributable to property other than property attributable

to an active trade or business. Investment income does not

include distributions from a qualified retirement plan or

amounts subject to self-employment tax. This rule applies mostly

to passive businesses and the trading in financial instruments

or commodities. With this additional tax, the maximum net

capital gains rate is 23.8% in 2014. Because distributions from

qualified retirement plans are not subject to the tax, taxpayers

may want to invest in retirement accounts, if possible, rather

than taxable accounts.

Timing

of Sales: You may want to time the sale of

assets so as to have offsetting capital losses and gains.

Capital losses may be fully deducted against capital gains and

also may offset up to $3,000 of ordinary income ($1,500 for

married filing separately). In general, when you take losses,

you must first match your long-term losses against your

long-term gains, and short-term losses against short-term gains.

If there are any remaining losses, you may use them to offset

any remaining long-term or short-term gains, or up to $3,000 (or

$1,500) of ordinary income. When and whether to recognize such

losses should be analyzed in light of the possible future

changes in the capital gains rates applicable to your specific

investments.

Dividends:

Qualifying dividends received in 2014 are subject to rates

similar to the capital gains rates. Therefore, qualifying

dividends are taxed at a maximum rate of 20% (23.8% if subject

to the net investment tax). Qualifying dividends include

dividends received from domestic and certain foreign

corporations.

Selling

Your (Underwater) Home: Qualified mortgage

debt relief from your lender discharged in 2014 will not be

considered income. Congress extended a previous tax benefit and

made it retroactive so any debt discharged on or after January

1, 2014, will not be considered income and taxes will not be

owed on the amount forgiven. |

|

|

|

Other

Tax Planning Opportunities

Social

Security: Depending on the recipient's

modified AGI and the amount of Social Security benefits, a

percentage — up to 85% — of Social Security benefits may be

taxed. To reduce that percentage, it may be beneficial to defer

receipt of other retirement income (but do not defer any

required minimum distributions to a subsequent year).

Alternatively, it may be beneficial to accelerate income so as

to reduce the percentage of your Social Security taxed in 2015

and later years.

Qualified

Tuition Programs:

§529 (MOST in

Missouri

and Quest in

Kansas

) qualified tuition programs are a good deduction on your state

returns and are available for parents and grandparents as well

as others.

Home Equity Debt: In some cases, you may consolidate outstanding

personal debts into a home equity debt. Interest on personal

debts is not tax-deductible, but you can deduct mortgage

interest paid on the first $100,000 of home equity debt in most

states, no matter how the proceeds are used. Caveat: The

debt must be secured by your home.

Estimated Tax Payments: You may be liable for an “estimated

tax penalty” if you fail to pay enough tax through any

combination of withholding or quarterly installments. But you

can avoid the penalty by paying enough to satisfy a “safe

harbor” of 90% of current tax liability or 100% of the

previous year’s tax liability (110% if your AGI was above

$150,000).

Retirement Savings: Increase deferrals to your

401(k) account to boost retirement savings. The maximum deferral

for 2014 is $17,500 ($23,000 if age 50 or older). |

|

|

|

Health

Care Planning

Individual

Mandate: Under the 2010 health care reform

law, sometimes called Obamacare, beginning in 2014, there is an

individual mandate requiring individuals and their dependents to

have health insurance that is minimum essential coverage or pay

a penalty unless they are exempt from the requirement. Many

people already have qualifying coverage, which can be obtained

through the individual market, an employer-provided plan or

coverage, a government program such as Medicare or Medicaid, or

an Exchange. For lower-income individuals who obtain health

insurance in the individual market through an Exchange, a

premium tax credit and cost-sharing reductions may be available

to offset the costs.

Health

Care Savings Accounts: For 2014, cafeteria

plans can provide that employees may elect no more than $2,500

in salary reduction contributions to a health FSA.

SHOP

Exchanges: Beginning in 2014, the Small Business Health

Options Program begins to allow certain small businesses to

obtain health insurance for their employees through an exchange.

The program is designed for employers with 50 or fewer employees

(100 or fewer, but states may limit the number to 50 for 2014

and 2015). Each state will offer its own SHOP marketplace.

Self-employed persons with no employees cannot use the SHOP

Exchange. A tax credit, discussed below, is available to some

businesses that pay part of the premiums for health insurance

obtained by their employees through a SHOP Exchange.

Self-Employed

Health Insurance Premiums: Self-employed

individuals are allowed to claim 100% of the amount paid during

the taxable year for insurance that constitutes medical care for

themselves, their spouses and dependents as an above-the-line

deduction, without regard to the general 10% of AGI floor.

Credit

for Employee Health Insurance Expenses of Small Employers:

Eligible small employers are allowed a credit for certain

expenditures to provide health insurance coverage for their

employees. Generally, employers with 10 or fewer full-time

equivalent employees (FTEs) and an average annual per-employee

wage of $25,400 or less are eligible for the full credit. The

credit amount begins to phase out for employers with either 11

FTEs or an average annual per-employee wage of more than

$25,400. The credit is phased out completely for employers with

25 or more FTEs or an average annual per-employee wage of

$50,800 or more. The credit amount is 50% of certain

contributions made to purchase health insurance (35% for a

tax-exempt eligible small employer). For 2014, the credit is

only allowable if the health insurance is purchased through a

SHOP Exchange and is only available for two consecutive taxable

years.

Health

Savings Accounts: A health savings account (HSA)

is a trust or custodial account exclusively created for the

benefit of the account holder and his or her spouse and

dependents, and is subject to rules similar to those applicable

to individual retirement arrangements (IRAs). Contributions to

an HSA are deductible, within limits. For 2014, the annual

limitation on deductions for an individual with self-only

coverage under a high deductible health plan is $3,300; for an

individual with family coverage under a high deductible health

plan is $6,550. For 2014, a “high deductible health plan” is

a health plan with an annual deductible that is not less than

$1,250 for self-only coverage or $2,500 for family coverage, and

the annual out-of-pocket expenses (deductibles, co-payments, and

other amounts, but not premiums) do not exceed $6,350 for

self-only coverage or $12,700 for family coverage. |

|

|

|

Alternative

Minimum Tax

For 2014, the alternative minimum tax

exemption amounts are: (1) $82,100 for married individuals

filing jointly and for surviving spouses; (2) $52,800 for

unmarried individuals other than surviving spouses; and (3)

$41,050 for married individuals filing a separate return. Also,

for 2014, nonrefundable personal credits can offset an

individual's regular and alternative minimum tax, and capital

gains will be taxed at lower favorable rates for AMT.

If you have a stock holding due to the

exercise of an incentive stock option during this year that is

now below the value at the exercise date (underwater), consider

selling the shares before the end of the year to avoid the AMT

tax due on the original exercise of the option.

Some of the standard

year-end planning ideas will not reduce tax liability if you are

subject to the alternative minimum tax (AMT) because different

rules apply. |

|

|

|

Business

Deductions

Equipment

Purchases: If you are in business and purchase

equipment, you may make a “Section 179 Election,” which

allows you to expense (i.e., currently deduct) otherwise

depreciable business property. For 2014, you may elect to

expense up to $500,000 of

equipment costs (with a phase-out for purchases in excess of

$2,000,000) if the asset was placed in service during 2014.

In addition, careful timing of equipment

purchases can result in favorable depreciation deductions in

2014. In general, under the “half-year convention,” you may

deduct six months worth of depreciation for equipment that is

placed in service on or before the last day of the tax year. (If

more than 40% of the cost of all personal property placed in

service occurs during the last quarter of the year, however, a

“mid-quarter convention” applies, which lowers your

depreciation deduction.) A popular strategy in recent years is

to purchase a vehicle for business purposes that exceeds the

depreciation limits set by statute (i.e., a vehicle rated over

6,000 pounds). Doing so would not subject the purchase to the

statutory dollar limit, $3,160 for 2014; $3,460 in the case of

vans and trucks. Therefore, the vehicle would qualify for the

full equipment expensing dollar amount. However, for SUVs (rated

between 6,000 and 14,000 pounds gross vehicle weight) the

expensing amount is limited to $25,000.

Capitalization

v. Expensing for Materials and Supplies and Repairs:

Effective for taxable years beginning on or after January 1,

2014, the IRS finalized regulations that determine when

taxpayers should capitalize or deduct as a current expense

repairs on tangible property, plus the deductibility of

materials and supplies. A deduction for materials and supplies

is allowed under a de minimis rule that includes property that

has an acquisition or production cost of $200 or less. Also,

another de minimis safe harbor states that for repairs to be

deductible, among other requirements, the unit of property must

cost less than $5,000 per invoice or item substantiated by the

invoice for taxpayers with applicable financial statements and

$500 per invoice for taxpayers without applicable financial

statements.

Home Office: When you

qualify for home office deductions, you may deduct certain

expenses incurred in connection with the business use. The IRS

recently approved use of a simplified home office deduction,

capped at $1,500. Expenses attributable to using the home office

as a business office are deductible under §280A if the home

office is used regularly and exclusively: (1) as a taxpayer's

principal place of business for any trade or business; (2) as a

place where patients, clients, or customers regularly meet or

deal with the taxpayer in the normal course of business; or (3)

in the case of a separate structure not attached to the

residence, in connection with a trade or business.

Travel and Meals &

Entertainment: A company may deduct 100% of business

travel costs and 50% of entertainment and meal expenses. Note

that a company can deduct 100% of the cost of a holiday party as

long as the entire workforce is invited. |

|

|

|

Business

Credits

Small

Employer Pension Plan Startup Cost Credit: For

2014, certain small business employers that did not have a

pension plan for the preceding three years may claim a

nonrefundable income tax credit for expenses of establishing and

administering a new retirement plan for employees. The credit

applies to 50% in qualified administrative and

retirement-education expenses for each of the first three plan

years. However, the maximum credit is $500 per year.

Employer-Provided

Child Care Credit: For 2014, employers may

claim a credit of up to $150,000 for supporting employee child

care or child care resource and referral services. The credit is

allowed for a percentage of “qualified child care

expenditures” including for property to be used as part of a

qualified child care facility, for operating costs of a

qualified child care facility and for resource and referral

expenditures.

Work

Opportunity

Credit: The work opportunity credit is an

incentive provided to employers who hire individuals in groups

whose members historically have had difficulty obtaining

employment. This gives your business an expanded opportunity to

employ new workers and be eligible for a tax credit against the

wages paid. Credit determined based on first-year wages paid for

employees hired on or before December 31, 2013. Therefore, for

2014, the credit will only apply to wages paid for workers hired

before that date during their first 12-month period of

employment. Certain long-term family assistant recipient wages

are counted for a second year. |

|

|

|

Please

note that this letter is intended only as a general guideline.

Your personal circumstances will likely require greater

examination. If you have any questions, please do not hesitate

to call. I would be happy to meet with you at your convenience

to discuss the strategies outlined above.

|

| |

Very truly yours,

Terri L. Winters, CPA |

Copyright 2003 all rights reserved

twinterscpa.com (816) 468-8000

|